Steel Market Price Changes

In August, steel exports increased by 21.33% month-on-month, and hot-rolled steel exports increased by 64.7% month-on-month.

1. Export prices of all steel varieties fell in August

Looking back at the steel export market in August, overall, the overall market demand is still weak and the recovery is slow, and overseas buyers are mostly in a cautious wait-and-see state. Throughout August, the average monthly export quotations of hot-rolled, cold-rolled, galvanized, medium, and thick plates, REBAR, and WIRE RODS fell by 39, 24, 22, 31, 28, and 34 US dollars per ton, respectively.

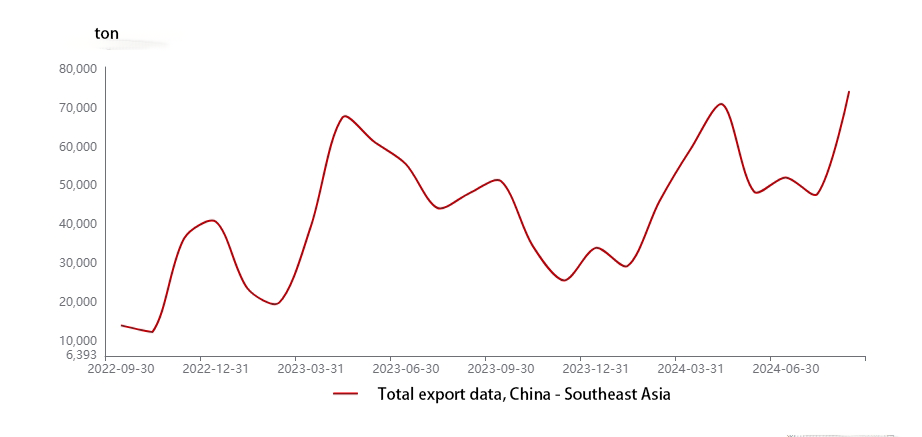

Changes in steel bar export volume

According to the latest data from Mysteel, as of September 24, the FOB prices of major steel varieties were: hot-rolled coils at $457 per ton, cold-rolled coils at $536 per ton, hot-dip galvanized coils at $586 per ton, medium and thick plates at $470 per ton, rebar at $478 per ton, and wire rods at $478 per ton. Future trends still need to pay attention to changes in demand.

( Note: Hot-rolled coils, cold-rolled coils, hot-dip galvanized coils and medium and thick plates are selected from Tianjin Port, and rebar and wire rods are selected from Zhangjiagang Port)

| China’s export volume of major steel products in August 2024 (10,000 tons) | ||||

| Varieties | August 2024 | Month-on-month | January-August 2024 | Year-on-year |

| Steel | 949.5 | 21.3% | 7072.2 | 20.8% |

| Bills | 53.5 | 52.1% | 235.9 | 7.6% |

| Rods and wires | 108.2 | 20.2% | 808.5 | 10.0% |

| Hot-rolled | 250.7 | 64.7% | 1828.8 | 42.7% |

| Cold-rolled | 81.0 | 29.9% | 541.1 | 22.9% |

| Medium and thick plates | 85.8 | 15.0% | 641.4 | 14.4% |

| Coated plates | 163.9 | 5.1% | 1234.1 | 20.1% |

| Coated plates (strips) | 71.9 | 20.7% | 488.0 | 18.0% |

| Angle profiles | 42.3 | 3.1% | 334.2 | 9.8% |

| Pipes | 82.0 | -1.9% | 692.7 | 3.2% |

| Railway steel | 12.2 | -8.0% | 95.2 | 22.9% |

| Electrical steel plates (strips) | 5.7 | -31.3% | 52.2 | 44.9% |

| Others | 46.0 | 9.4% | 355.9 | 16.4% |

II. Increase in total steel imports and exports

In August 2024, the export volume of steel was 9.5 million tons, an increase of 21.33% month-on-month and 14.8% year-on-year. From January to August, the cumulative export volume was 70.58 million tons, an increase of 20.6% year-on-year. In August 2024, the import volume of steel was 510,000 tons, an increase of 2% month-on-month and a decrease of 20.5% year-on-year. From January to August, the cumulative import volume was 4.63 million tons, a decrease of 8.4% year-on-year. Overall, the export volume of steel in August turned from a decrease to an increase month-on-month, and the import volume increased slightly.

3. Exports of major steel products increased month-on-month

In August, my country’s finished steel exports increased significantly. In terms of varieties, the increase in hot-rolled exports was the most obvious, up 64.7% month-on-month to 2.507 million tons, becoming the largest steel variety exported in my country that month; the export volume of coated plates was 1.639 million tons, up 5.1% month-on-month, and the export of steel billets increased significantly by 52.1% to 535,000 tons.

( Note: Hot rolling includes hot-rolled thin plates, hot-rolled thin wide steel strips, hot-rolled narrow steel strips and medium-thick wide steel strips, and cold rolling includes cold-rolled thin plates, cold-rolled thin wide steel strips and cold-rolled narrow steel strips)

| Top 10 destination markets for China’s finished steel exports in August 2024 (10,000 tons) | ||||

| Countries/Regions | Monthly value | Month-on-month | Annual cumulative value | Year-on-year |

| Vietnam | 92.4 | 47.6% | 792.3 | 51.1% |

| South Korea | 71.1 | 34.0% | 566.3 | -1.3% |

| Thailand | 49.4 | -6.1% | 353.6 | 12.3% |

| Saudi Arabia | 48.3 | 68.3% | 295.2 | 47.5% |

| UAE | 47.9 | 23.4% | 343.9 | 51.1% |

| Philippines | 46.4 | 12.3% | 338.5 | 20.1% |

| Indonesia | 42.2 | 19.3% | 299.2 | 31.0% |

| India | 36.2 | 24.5% | 207.1 | 44.0% |

| Malaysia | 33.6 | 96.4% | 186.9 | 40.8% |

| Turkey | 33.4 | 45.9% | 274.3 | -8.7% |

4. Vietnam, South Korea and Thailand are still the top three steel exporters in my country

In August, the top three destinations for my country’s steel exports were still Vietnam, South Korea and Thailand, which was consistent with the performance of the previous month; the amount of steel exported to Thailand decreased by 6.1% month-on-month to 494,000 tons, and the amount of steel exported to Saudi Arabia increased significantly by 68.3% to 483,000 tons, slightly lower than Thailand. It can be seen from the table that Southeast Asian countries are my country’s main export destinations, and the amount of steel exported to my country’s steel export destination markets has generally increased compared with July.

5. Summary

Overall, the performance of steel exports in August exceeded market expectations. Against the background of rising anti-dumping news, significant rise in geopolitical uncertainty, and heightened expectations of anti-globalization, the outstanding export performance in August may be related to the “rush for exports.” Behavior-related, that is, in the quarter after the tariff threat was implemented and in the quarter before the tariff measures took effect, exports increased significantly, showing super-seasonal characteristics. Although September is the traditional peak season, in the context of strengthening overseas recession expectations, it is expected that steel exports may not be able to continue their considerable growth in the later period.

WhatsApp: +86 13938459717(Click To Directly Chat)

My Email: info03@wanzhisteel.com (Click To Email Me )

Leave Us A Message